- Home ›

- One Stop Europe ›

- Customs and Duties

Customs and Duties

Putting all Europeans on an equal footing

At A Glance

- Ecommerce 2.0 : How the wider ecommerce stakeholder community is helping shape the standards for delivery of goods & services in the EU and beyond.

- New European standards remove cross-border ecommerce hurdles through unified processes and procedures for customs and duties for low-value consignments.

Adapting the 4 basic freedoms of the single market – the free movement of goods, services, capital and people – so that they are equally applicable in the digital domain is particularly important for the economies of leading export nations such as Germany.

Any European state intending to succeed as an

ecommerce economy must quickly and permanently implement these framework

conditions.

Case study: Germany

Germany has slipped back into third place in Europe’s ecommerce rankings. It currently lacks the basic infrastructure of trust services needed to facilitate the digital identification of persons, the secure transfer of electronic documents and data, and to ensure data integrity and authenticity [1].

As a world-class exporter, ecommerce is a vital economic factor for Germany. But if it fails to use the potentials offered by new digital media, it will not be able to realise the efficiency gains and economies of scale that come with the transition from analogue to digital trade.

The companies that will profit in the digital single market are those that know their customers, gain and do not abuse their trust, offer the products and services they need, and act in accordance with the rules of the digital single market.

Ecommerce Europe helping shape the foundations of ecommerce

The foundations and core elements of the infrastructure for tomorrow’s digital single market have been established. Now they need to be implemented. Growing at a rate of over 10% per year, cross-border ecommerce will be a key driver of growth in the EU.

However, as digitalisation progresses, the failure to establish a truly borderless market and fully implement the 4 basic freedoms of the EU is becoming increasingly obvious.

Over the past 3 years Ecommerce Europe, working together with the German Händlerbund, has identified the key hurdles to seamless cross-border ecommerce:

- Excessive delivery charges,

- A lack of the transparency needed to encourage competition,

- Administrative hurdles, including differences in consumer rights, customs and VAT regulations.

These are the key factors holding back online

trade and growth in the EU.

The largest European Ecommerce association member –- the German

Händlerbund – has played an active role in defining the principles

needed to eliminate these hurdles to cross-border ecommerce in the

digital

single market.

Standardised interfaces for real time customs and duties handling

Now stakeholders are starting to create open and transparent standards for the interfaces needed in seamless cross-border ecommerce. This includes secured data communication between the sender and the financial authorities.

The aim is threefold:

- To identify the applicable customs and duties in real time when concluding the purchasing agreement on an online marketplace or portal,

- To register these sums with the relevant authorities and, where applicable,

- To make the relevant payments.

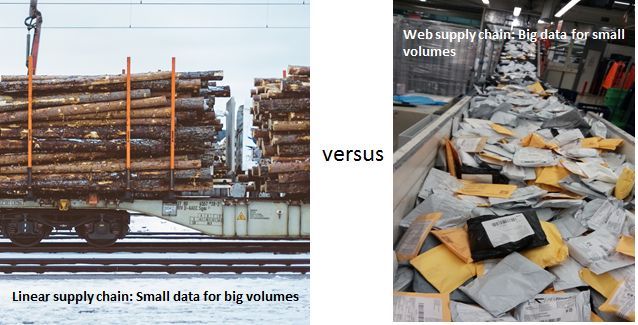

Fig.1: In the analogue world SMALL data was good for big volumes; in the digital world BIG data is necessary for small volumes

Fig.1: In the analogue world SMALL data was good for big volumes; in the digital world BIG data is necessary for small volumesOver 75 different VAT rates in the EU....

Just as goods are tracked via barcodes in supermarkets in the analogue world, so harmonized parcel labels on ecommerce shipments allow parcels to be directly linked to their contents and, in turn, to their recipient.

The VAT due on the purchase is calculated according to the VAT rate of the country in which the recipient is located.

As soon as the parcel is handed over to the parcel service for delivery, the delivery time is fixed and the consumer informed. At the same time, the online marketplace or portal in the digital world takes on the same role as the marketplace in the analogue world. The analogue processes are very similar to the digital processes.

Marketplaces create frameworks, but are neither sellers nor buyers

Online marketplaces function as transaction intermediaries: just like a market in the analogue world, online marketplaces themselves are neither buyers nor sellers, instead they offer the framework within which transactions take place.

Accordingly, marketplaces offer a variety of services, both upstream and downstream of the transaction itself. This leads to ecosystem-type solutions designed for customer retention.

It is precisely here that ecommerce associations, and in particular Ecommerce Europe, are focusing their efforts to create standards.

The European Commission, working in close cooperation with Ecommerce Europe, and with Händlerbund supporting these efforts actively via the German institute for standardisation DIN, has issued a mandate to the European Standardisation Committee CEN, to draw up standards covering:

- Requirements for the advance electronic transfer of data with respect to the delivery of products and services, especially with regards to security and customs requirements, &

- Requirements for the connection, access to, involvement in and future development of open, global networks and systems for postal operators and players in the wider postal sector.

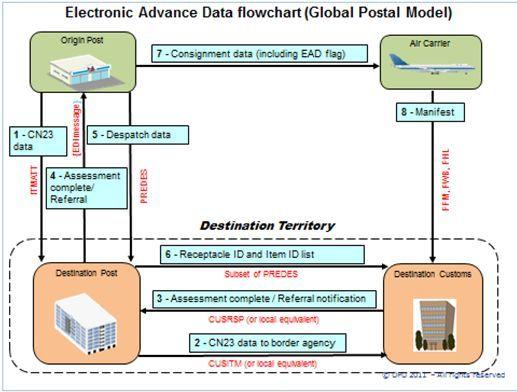

Fig.2: The flowchart illustrating electronic advanced data (EAD) currently applicable to the global postal customs and duty model will be extended to include the wider postal sector players (Source: IPC/UPU)

Fig.2: The flowchart illustrating electronic advanced data (EAD) currently applicable to the global postal customs and duty model will be extended to include the wider postal sector players (Source: IPC/UPU)The goal is to provide authorities and other stakeholders in the process with data in advance. This allows authorities to determine the extent of controls required for cross-border transactions before the parcel arrives in the destination country.

It should be possible to calculate the customs fees, import duties, and similar levies with precision at the point at which the transaction is concluded.

Removal of existing VAT exemption for low-value consignments

Europe's ecommerce market is currently distorted by some non-EU traders who abuse the VAT exemption for low-value consignments in order to gain a competitive advantage.

Consequently, European ecommerce associations support the European Commission’s proposal to remove the existing VAT exemption for non-EU traders.

Instead it demands:

- an import regulation covering

the distance selling of goods with a specific total value of < 150

euros originating from non-EU states,

- and the introduction of a simplified regulation for a global declaration and payment of import VAT where the import regulation outlined above is not applied.

In accordance with the new import scheme, non-EU sellers will first have to identify themselves for VAT purposes in at least one EU state designated by the seller.

Upon identification, the non-EU seller will be able to declare and pay import VAT on shipments destined for EU consumers by filing quarterly VAT returns via an extension of the MOSS (Mini-One-Stop-Shop).

Unlike today, VAT will be collected at the point of sale by sellers or marketplaces. These consignments will then benefit from a fast-track customs mechanism.

VAT is collected at the point of sale, and paid each quarter

The suggested European Union guideline will also allow the member states to enable the person presenting the goods to EU customs (usually the postal operator, or courier, express or parcel service) to register the VAT due for this parcel via monthly electronic tax declaration, and to pay the tax on behalf of the person receiving the goods.

From the standpoint of the ecommerce associations, the new import regulations enable the member states to increase the collection of import VAT on low-value consignments, while at the same time helping to protect European retailers from unfair tax competition from non-EU sellers.

This avoids burdensome customs processes for importing individual consignments, whilst at the same time guaranteeing effective and simplified processes to lower the costs of tax collection for all parties involved in the process.

To summarize: the proposed European Union regulations on customs and duties will be a key step in harmonizing cross-border ecommerce within Europe, raising the efficiency of associated processes, and removing the distortions caused by unwarranted preferential customs treatment currently accessable to non-EU sellers.

[1] The necessary pan-European and global framework conditions have been in place since the EU implemented the eIDAS Regulation (EU 910/2014).

- Home ›

- One Stop Europe ›

- Customs and Duties

Does this article cover a topic relevant to your business? Access the CLS Business Lounge for the market intelligence you need to stay ahead of the crowd. Find out more