- Home ›

- One Stop Europe ›

- B2B2C

B2B2C

Why business to business to customer (B2B2C) leads to delivery chain management

At A Glance

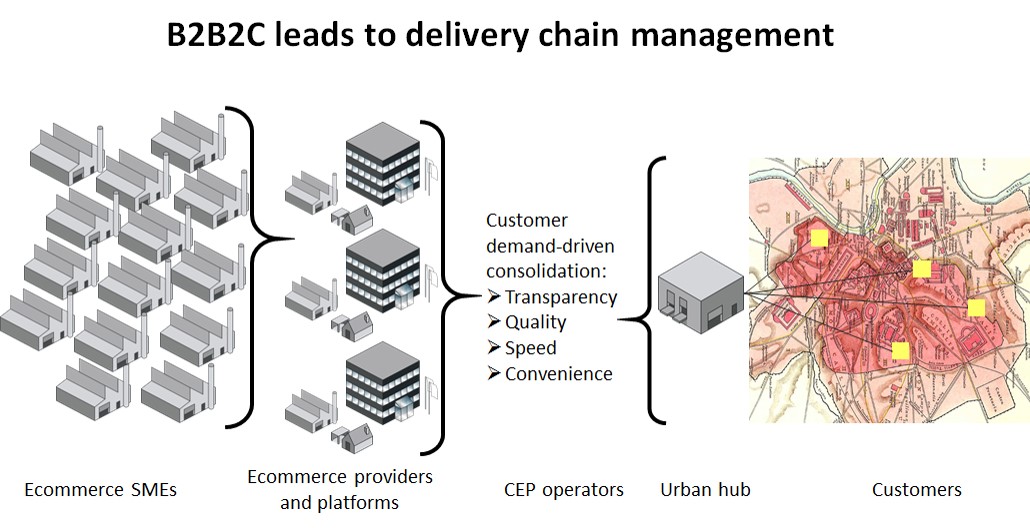

According to Techopedia, “Business to Business to Consumer (B2B2C) is an emerging ecommerce model that combines Business to Business (B2B) and Business to Consumer (B2C) for a complete product or service transaction. B2B2C is a collaboration process that, in theory, creates mutually beneficial service and product delivery channels.”

In its current form this ecommerce model takes one of two forms:

- SMEs sell products and services using the infrastructure provided by a leading retail platform which also operates as 3PL providers. The SME uses the platform’s entire range of services, from supply chain management through to payment processing (e.g. Amazon marketplace). Around 100–150 well-established European online retail platforms currently offer this service.

- Alternatively, SMEs use the services of a neutral platform provider offering modular supply chain components on a pick-and-choose basis. The provider also supports a variety of interfaces to different portal platforms. Examples of this model include several European start-ups offering middleware. They also support sales channels via various platforms in different countries.

Growing ecommerce demands a different type of delivery network

As the European and international ecommerce market grows and matures, the complexity and costs of selling online are increasing. Retailers need to consolidate and create synergies if they are to thrive.

And delivery is a significant cost factor in any online transaction.

In a digital economy, a delivery model consisting of competing monopolies, reserved areas of interest, and closed standards has no future:

- Consumers want online purchases to be delivered quickly, cheaply and reliably, ideally with the extra option of alternative drop-off locations and time-specific delivery. They don’t care which service provider actually turns up at their front door.

- Online retailers want each parcel they send out to be delivered in the fastest and most cost-efficient manner – locally, regionally, nationally or internationally. They don’t care which service provider actually turns up at the customer’s front door.

The demands of both consumers and online retailers can only be satisfied by commoditising delivery and integrating delivery chain management into the B2B2C model.

B2B2C encourages the growth of delivery chain management

Quite simply, delivery chain management is the process of directing delivery of a product to the last mile delivery service provider most able to meet the specific delivery preferences as stated by the consumer during the purchasing process.

As the B2B2C business model continues to grow strongly, delivery chain management is the only means of ensuring cost-efficient delivery and eliminating system discontinuities.

It requires cooperation between online retail platforms and delivery service providers, exchanging data by means of end-to-end shared standards (e.g. GS1), and mapping delivery against service levels. This, in turn, has an impact on delivery models and removes dependence on third parties.

Next step: removing the system breaks between ecommerce and delivery

Today’s B2C delivery processes are primarily determined by the national postal administrations/designated operators (DO) who enjoy exclusive access to the global postal network and IT applications exclusively operated by the Universal Postal Union for global postal exchange on their behalf and at marginal cost.

As the European postal market has increasingly liberalised there has been a huge rise in the volume of commercial letter post items.

At the same time, retail delivery prices have harmonised with exchange prices, set as the settlement tariffs between the DOs for delivery in the territory of each individual UPU member state.

When it comes to cross-border delivery, the delivery prices for commercial letter post items sent between the market-dominant DOs are set by a system of multilateral agreements, agreed at UPU level.

Anyone sending items privately, or who does not have the access or necessary volumes to negotiate preferential rates with DOs, pays up to 4-times the national tariff for cross-border delivery within the EU, and much more globally.

At the same time, private courier, express and parcel services serve the same end customers as the DOs, but are forced to operate in parallel systems outside DO networks.

Simultaneously, the growth in commercial letter post items is increasingly dissolving the boundaries between courier, express and parcel services.

Designated operators are contributing to their own demise

Delivery services using data-supported and clearly optimised logistics chains can easily consolidate, enabling delivery routes to be directed to national, regional and local delivery services.

Ironically, the DOs themselves have demonstrated how this can work and what is required to do so: when it benefits them to do so, they deliberately operate outside their own monopoly structures (e.g. the Deutsche Post AG’s departure from the multilateral REIMS V contract) in order to optimise markets in which they are themselves active outside their own protected position (e.g. as DHL).

They prefer to do this than to partner up with other DOs and compete with players in the courier, express and parcel sector (to which they themselves now partly belong).

The rise of middleware is a system-imminent threat to DOs..…

If we look at the major online retailers, who currently generate around 10% of parcel volumes in selected EU markets, we can see that they are taking steps to creating their own delivery chain management through consolidation and optimisation.

They do this by creating middleware which locates existing prices for the delivery service which best meets the consumer’s demands.

Data management – starting from the order by the customer on the online platform, through to pre-sorting for final mile delivery – is the backbone for preparing item-specific delivery services.

It doesn’t matter if one service provider covers the first delivery mile, a second the transport, and a third actual delivery to the end customer.

What is important is that the middleware can monitor the entire process, guaranteeing that each service level has been fulfilled.

….and by 2019 it’ll be too late to react

When private German bank Lampe stated in Die Welt (9 March 2016) that Deutsche Post AG will not feel the impact of restructuring in the parcel delivery markets much before 2019, they hadn’t properly analysed the fundamentals.

The middleware that is about to disrupt the Deutsche Post business model is currently being tested as a prototype in Germany, and has already been successfully implemented – and exceeded all expectations in the UK – currently Europe’s no. 1 ecommerce market.

The 7 factors leading to delivery chain management

- Despite the overall growth in ecommerce volumes, traditional parcel delivery providers (DOs) are losing market share to regional and local entrants who offer direct access to last mile consolidated delivery.

- The differences between the products offered by courier, express, and parcel delivery providers are dissolving as the classic standard parcel (“one solution for everything”) disappears.

- Vertical silo-like solutions offered by traditional parcel delivery providers are being supplanted by horizontal, supplier-neutral collaborative solutions.

- The use of open standards (e.g. GS1) facilitates data exchange, allowing solutions to better fulfil consumer expectations. Delivery chain management maps delivery against service level agreements.

- B2B2C solutions lead to transparent tariffs which come very close to the actual production prices of delivery providers. DO “roaming” for commercial letter post items provides the blueprint.

- Delivery network management solutions are already being deployed in leading European ecommerce markets. Tests are being conducted in Germany. Solutions for the European cross-border market are expected midterm.

- Downstream additions to the delivery chain, such as countrywide access to B2B networks to end-customers, using pick-up, drop-off and shop-in-shop solutions, are further intensifying the current trend towards horizontal collaboration between existing CEP structures.

The shape of things to come

The services offered by today’s market-dominant DOs will simply be incorporated into delivery chain management systems. The DOs will not succeed in offering their own solutions exclusively as standalone services.

Delivery chain management will be activated directly by data generated via the online retail platforms (including related upstream and downstream 3PL, or 4PL providers).

The supply chain pre-sorts for the different delivery providers according to the service levels agreed via the online platform.

The result is a highly efficient and cost-optimised B2B2C delivery offering which meets specific customer requirements.

Walter Trezek is the Chairman of the Consultative Committee (CC) of the Universal Postal Union (UPU).

- Home ›

- One Stop Europe ›

- B2B2C

Does this article cover a topic relevant to your business? Access the CLS Business Lounge for the market intelligence you need to stay ahead of the crowd. Find out more