- Home ›

- One Stop Europe ›

- B2C E Commerce

B2C E Commerce

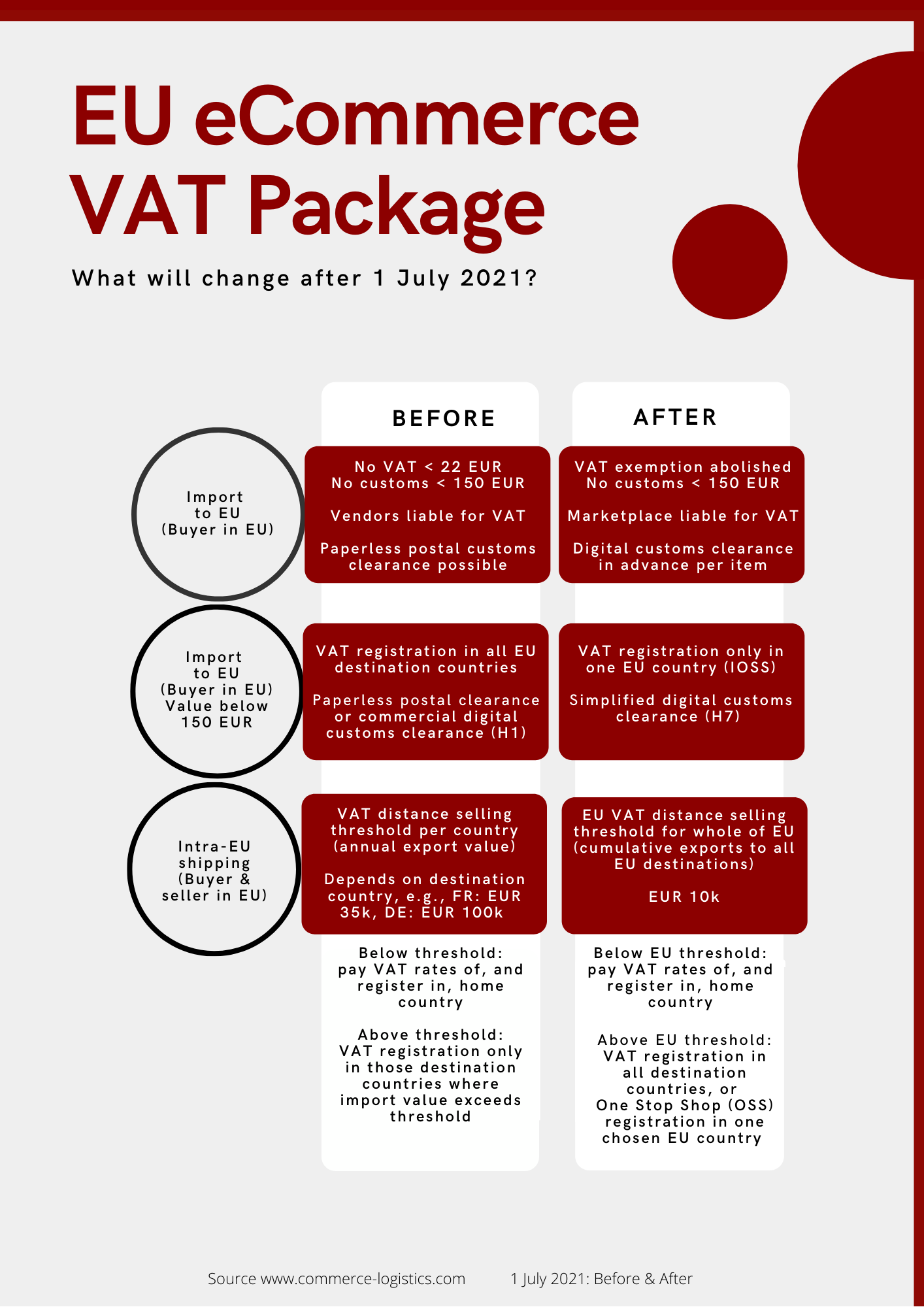

Before

and after 1 July 2021: the key changes to B2C e commerce following introduction of the EU

VAT e-commerce package

8 June, 2021

Author: Martin Füll Linkedin

Share this article:

The Ecommerce Big Bang Series

Just as the ‘Big Bang’ of 1986 revolutionized the financial markets, the EU eCommerce VAT Package which comes into effect on 1 July 2021 will redefine global online retail. Our Ecommerce Big Bang series is your guide to the future of European ecommerce:

- Before and after – the key changes to B2C e-commerce

- Importing goods into the EU: the Import One Stop

Shop (IOSS)

- Cross-border distance selling in the EU: the One Stop Shop (OSS)

- Why OSS may only be a transitional solution for cross border trade

- Will new postal fees for IOSS effectively end the UPU universal service in the EU?

Ecommerce’s ‘Big Bang’

On 1 July 2021 the EU VAT e-commerce package comes into force. By mandating the fully digital handling of import

customs & VAT on all transactions, and with import VAT due on every

shipment to the EU, it will impact all B2C e commerce stakeholders, both in Europe

and globally.

In this, the first in our Ecommerce Big Bang series, we outline the major areas of change impacting all ecommerce stakeholders, in Europe and globally.

B2C E Commerce Prior to 1 July 2021

All goods and shipments valued at

less than EUR 22 entering the EU were exempt from import VAT. Shipments from

third countries outside the EU up to a value up to 150 EUR were also customs duty free. Paper-based processes were

sufficient for the import customs clearance procedures conducted by postal operators

– and consequently 2/3rds of commercial item shipments to the EU used the

postal channel.

This lack of digitalized processes

meant a lack of transparency. Consequently, the postal channel has been

frequently misused for import VAT evasion, online retail fraud, and a boom in

illegal trade.

By digitalizing all import VAT and

customs clearance processes, the EU VAT e-commerce package puts an end to these

practices. It also revolutionizes the ecommerce business model: customs, import

VAT and shipping channels become independent entities – allowing importers to

optimize flexibility and cost by choosing different service providers for each

transactional channel.

The EU VAT e-commerce package comes on the heels of the Universal Postal Union’s (UPU) mandatory electronic advanced data (EAD) notification for every individual cross-border commercial mail item destined for delivery within the networks of designated postal operators worldwide. EAD according to UPU's Global Postal Model came into force globally on 1 January 2021.

The Key Changes To B2C E Commerce

- Removal of VAT exemptions: The VAT exemption on imported goods valued below EUR 22 disappears. All goods imported into the EU will now be subject to import VAT, irrespective of their value.

- Simplified VAT payment system: The EU has created a simplified VAT payment model, the Import One Stop Shop (IOSS), for importing goods into the EU. Online sellers can register in a single EU Member State, and this registration is valid for the declaration and payment of all import VAT for all goods sent to any country in the EU. This new, simplified IOSS model is only valid for shipments valued at below EUR 150. It is still possible to use the ‘old’ scheme (register and pay in each EU Member States you sell to), but this will be more complex and expensive. There is no change for shipments with a value exceeding the EUR 150 import VAT threshold.

- Electronic advance data (EAD) for customs clearance: All imports into the EU, irrespective of value, must be declared in advance, at the border. To make customs clearance for shipments up to EUR 150 easier and less expensive, the EU has created a simplified, fully automated customs procedure which requires less data. No shipment will be allowed to enter EU if the seller or its agent has not sent digital customs data in advance (EAD) to the responsible authority.

- Marketplaces liable for collecting VAT payments: Each marketplace becomes fully liable for the payment of VAT due on all transactions which use its platform – even if the order goes to an independent online seller using the marketplace as a sales channel.

Who

is impacted by the new EU VAT e-commerce regulations?

In short, the new regulations impact everyone involved in

cross-border B2C e commerce, including online sellers and

marketplaces/platforms both inside and outside the EU, postal and express operators, customs authorities, and tax administrations, right through to consumers

themselves.

As a result of these changes, as of 1 July 2021 sellers located outside the

EU engaged in B2C e-commerce with the EU, as well as those located in the EU and importing into the EU, will be divided into 2 ‘worlds’,

depending upon the value of the commercial item they ship to the EU:

- Import of shipments valued ABOVE EUR 150: there will be no major changes. It is important to note here that ‘value’ is calculated per shipment, irrespective of the order, i.e., if an order is valued at EUR 200, but the goods are sent in two separate packages, each valued at EUR 100, then they are impacted by the new regulations and the IOSS may apply.

- Import of shipments valued BELOW EUR 150: both VAT and customs clearance procedures change.

The reasons for the EU VAT e-commerce Package

In the European Commission's own words:

“We are making life simpler and fairer for all....to re-establish fair competition between European and foreign e-commerce market players, as well as between e-commerce and traditional shops.”

As well as creating a level playing field, there are clear financial interests behind the introduction of the EU VAT e-commerce Package.

The existing model not only gave non-EU online sellers a price advantage when selling shipments valued below 22 EUR to EU consumers, this also resulted in lower tax revenues (import VAT) for EU member states, with billions of shipments entering the EU tax free. The new model will add many billions of VAT to tax revenues. As an example, a 2017 European Commission feasibility study calculated that, based on 2015 figures, VAT fraud, avoidance, non-compliance and false registration accounted for an annual revenue loss of up to EUR 190 billion for the EU as a whole.

In addition, as there is no import without data and digital customs clearance, it will be easier in future to prevent fraud and product counterfeiting.

Author: Martin Füll Linkedin

Share this article:

Unsure how these changes will impact your business? Contact us for a

free initial consultation. For more information see the CLS Blog and the EC’s Tax and Customs Union

website.

The CLS Commerce Logistics Specialists are actively shaping the new, legal environment for digital commerce at the Universal Postal Union (UPU), as experts on EU Commission Working Groups (DG TAXUD, DG MOVE), and through Ecommerce Europe (the umbrella association of Europe’s national ecommerce associations), and European Standardization (CEN). CLS is supporting and advising a variety of stakeholders in the industry – postal operators, logistics service providers, online shops and marketplaces.

- Home ›

- One Stop Europe ›

- B2C E Commerce

The Commerce Logistics Specialists provide the advice and support you need to succeed in this evolving digital commerce & logistics environment.

35+ Years' Experience

We serve a wide variety of European & international clients in all areas of Digital Commerce & Logistics.

Powerful Network

We work directly with the EU Commission, UPU, public authorities, regulators, global associations & major industry stakeholders.

Shaping the Industry

We are international experts in our field, chosen to help determine tomorrow’s European and global standards.

Contact us to find out more.