- Home ›

- One Stop Europe ›

- Ecommerce Trends 2020

Ecommerce Trends 2020

Ecommerce Europe Survey Reveals the Impact of COVID-19 on Online Sales in 2020

At A Glance

- According to a new survey on ecommerce trends 2020 by Ecommerce Europe, accelerating digitalization in European retail trade following the COVID-19 pandemic is leading to steady growth in the ecommerce sector. Businesses and consumers are both driving this growth.

- Further growth is expected in retail goods and services in 2021 – the scale will depend on the severity of COVID-19 measures.

- Ecommerce has become a lifeline for many traditional brick-and-mortar companies, allowing them to conduct business online while their stores have been forced to close during lockdown.

Ecommerce Europe has just published the results of its new survey on ecommerce trends 2020 during the second lockdown in Europe.

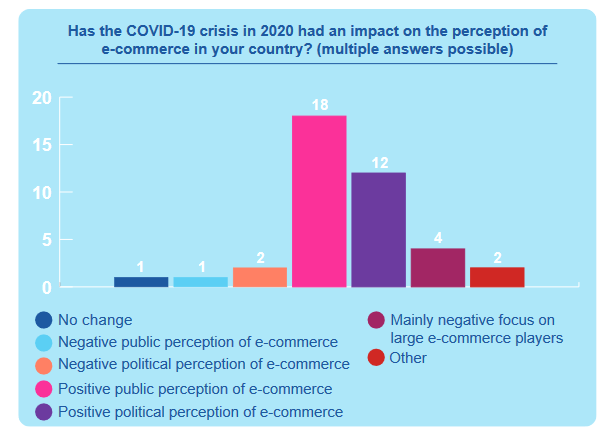

Perception of retail ecommerce during the COVID-19 pandemic: by country

While the 19 national ecommerce associations who contributed to the survey reported positive public perceptions of ecommerce overall during the COVID-19 pandemic, the political perceptions were more nuanced: France, Belgium, Austria and Spain reported an overwhelmingly negative attitude towards the major, dominant ecommerce players.

Italy reported that part of the public has objected to the growth in online retail, favouring support for local brick-and-mortar shops. Similar sentiments were expressed in Denmark.

Fig. 1: Perceptions of Ecommerce by Country. Source: Ecommerce Europe, 2020 Survey on the impact of COVID-19 on Ecommerce

Fig. 1: Perceptions of Ecommerce by Country. Source: Ecommerce Europe, 2020 Survey on the impact of COVID-19 on EcommerceOther countries reported successful experiences of brick-and-mortar neighbourhood shops moving online in order to continue selling to customers. In France, for example, the COVID-19 pandemic highlighted consumer expectations that local retailers should also offer the option of online shopping with home delivery. These consumer expectations – present since the start of lockdown – clearly indicates shoppers’ interest in omnichannel offerings such as those already offered by leading digital retailers, and now also demanded of local neighbourhood merchants.

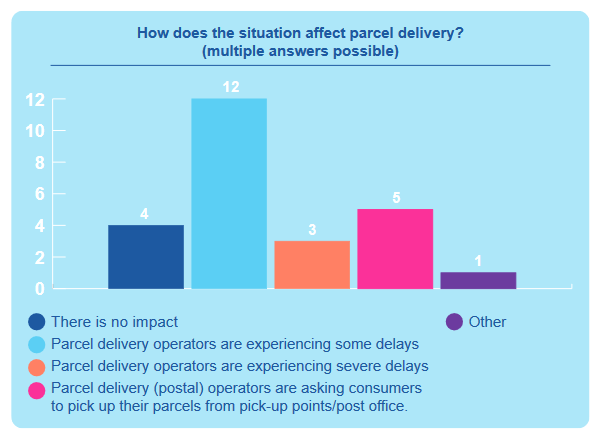

Impact of COVID-19 on parcel delivery

Arguably, the most noticeable ecommerce trend in 2020 was delays for parcel delivery operators, with 4 of the EU countries describing these delays as “severe”. Another 5 countries reported that parcel delivery operators were asking consumers to collect their parcels from designated pick-up locations.

Fig. 2: Impact on Parcel Delivery. Source: Ecommerce Europe, 2020 Survey on the Impact of COVID-19 on Ecommerce

Fig. 2: Impact on Parcel Delivery. Source: Ecommerce Europe, 2020 Survey on the Impact of COVID-19 on EcommerceIt was striking that the delays in parcel delivery during the second lockdown (November, December 2020) were seen as less severe than those during the first one.

It was also reported that in many EU countries the strict lockdown measures led to both a shift in consumer behaviour towards online retail, as well as further growth in demand during the Christmas period. Combined, this led to parcel delivery services needing to establish additional collection points to manage the increased flow of parcels.

The impact of COVID-19 on ecommerce by product category and country

The 19 national ecommerce associations contributing to the survey noted differences between demand for products and services during the second COVID-19 pandemic lockdown:

Products:

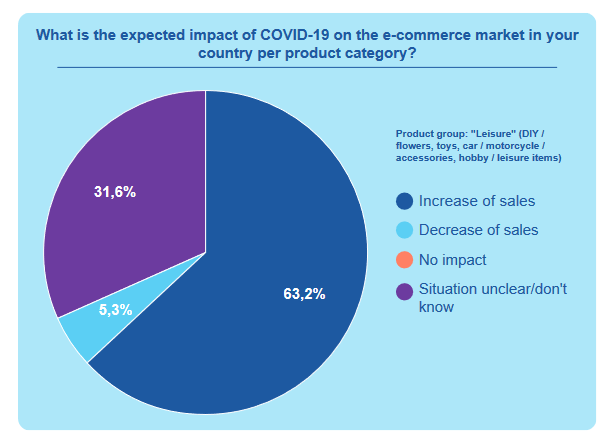

- The majority of the associations registered a 30% to 40% increase in revenue for leisure products.

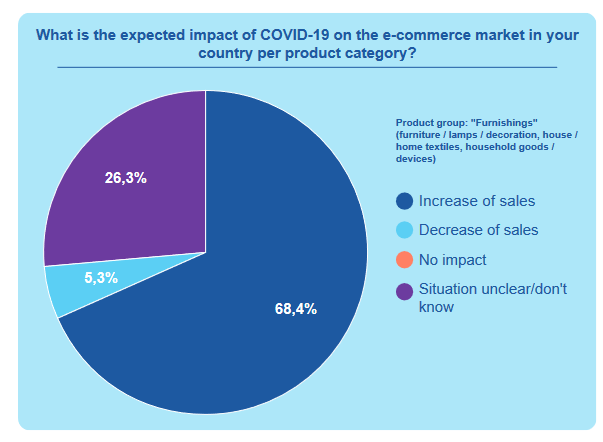

- The situation was similar for the furnishings sector, with greater demand in Q3 2020, and the Netherlands and Sweden registering growth of 106% and 73% respectively for online sales in this sector.

- Most EU member states saw a rise in online sales of essential products and entertainment, similar in scale to that during the first lockdown in spring 2020.

- Half of Ecommerce Europe members noted a rise in sales of clothing and shoes suitable for home wear, while other types of shoes and clothing saw a decrease in demand.

Fig. 3: Expected Impact on Sales of Leisure Goods. Source: Ecommerce Europe, 2020 Survey on the Impact of COVID-19 on Ecommerce

Fig. 3: Expected Impact on Sales of Leisure Goods. Source: Ecommerce Europe, 2020 Survey on the Impact of COVID-19 on Ecommerce Fig. 4: Expected Impact on Sales of Furnishings. Source: Ecommerce Europe, 2020 Survey on the Impact of COVID-19 on Ecommerce

Fig. 4: Expected Impact on Sales of Furnishings. Source: Ecommerce Europe, 2020 Survey on the Impact of COVID-19 on EcommerceServices:

- A significant majority of the associations saw a decline in revenue of between 40% and 70% for services, in particular for the sale of travel and online tickets.

All in all, ecommerce was generally a beneficiary of the COVID-19 pandemic. However, the situation is nuanced. Several categories did succeed in increasing revenue, while others suffered a threatening volume of losses.

Ecommerce growth trends for 2020

All the national ecommerce associations reported positive growth in the online sale of goods during 2020. Growth ranged from 5% to 10% in Poland, and 60% to 75% in Finland.

However, the performance for the online sale of services was less positive: 6 ecommerce associations (Norway, Austria, Bulgaria, France, the Netherlands, and Italy) indicated a decline over 2019, with Norway registering a 60% fall in the online sale of services compared to the previous year.

Taken together, most ecommerce associations reported growth in the digital sale of products and services in 2020, estimated at between 44% in Ireland and 4% in the Netherlands. In contrast, compared to 2019, Italy and Norway report a total decline of 20% and 3% respectively, the outcome of the overwhelming fall in online revenue for services.

While the ecommerce sector in Europe registered overall growth in 2020, this trend is not universal, and reflects the varying levels of demand for products and services during the pandemic.

Expectations for the ecommerce sector in 2021

All the participating national ecommerce associations forecast growth in the ecommerce sector in 2021; 11 associations were “very confident” and 8 “fairly confident”. Due to increased public trust and general changes in consumer behaviour, most of the growth in ecommerce will be permanent, rather than a direct consequence of the pandemic.

A few associations are unsure about growth in ecommerce once COVID-19 lockdown measures have been eased. The majority of associations expect significant growth in the online sale of products in 2021, while growth in online sales of services such as travel will depend on a the relaxation and/or removal of the current restrictive measures.

All in all, Europe’s ecommerce associations understand that the COVID-19 pandemic has accelerated the process of digitalization in Europe’s businesses, and this will lead to steady growth in the ecommerce sector, driven equally by both businesses and consumers. In addition, during the pandemic ecommerce has become a lifeline for traditional, brick-and-mortar outlets. Ecommerce has proven to be resilient. It has allowed increased demand from consumers to be met and has secured the delivery of essential goods and services.

You can access the ecommerce trends 2020 survey here. The contributing countries were Austria, Belgium, Bulgaria, Czech

Republic, Denmark, Finland, France, Germany, Greece, Italy, Ireland,

Netherlands, Portugal, Norway, Poland, Romania, Spain, Sweden, and Switzerland.

Ecommerce Europe is the sole voice of the European Digital Commerce sector. Via its 23 national associations, Ecommerce Europe represents more than 100,000 companies selling goods and services online to consumers in Europe. Ecommerce Europe acts at European level to help legislators create a better framework for online merchants, so that their sales can grow further.

Walter Trezek is co-chair of the Ecommerce Europe e-logistics Working Group and is the organization’s official representative to the UPU and DG TAXUD and ERGP.

- Home ›

- One Stop Europe ›

- Ecommerce Trends 2020

The Commerce Logistics Specialists provide the advice and support you need to succeed in this evolving digital commerce & logistics environment.

35+ Years' Experience

We serve a wide variety of European & international clients in all areas of Digital Commerce & Logistics.

Powerful Network

We work directly with the EU Commission, UPU, public authorities, regulators, global associations & major industry stakeholders.

Shaping the Industry

We are international experts in our field, chosen to help determine tomorrow’s European and global standards.

Contact us to find out more.