- Home ›

- One Stop Europe ›

- IOSS – Import One Stop Shop

IOSS

The Import One Stop Shop (IOSS): everything you need to know about the simplified VAT payment model

11 June, 2021

Author: Martin Füll Linkedin

Share this article:

The Ecommerce Big Bang Series

Just as the ‘Big Bang’ of 1986 revolutionized the financial markets, the EU eCommerce VAT Package which comes into effect on 1 July 2021 will redefine global online retail. Our Ecommerce Big Bang series is your guide to the future of European ecommerce:

- Before and after – the key changes to B2C e-commerce

- Importing goods into the EU: the Import One Stop

Shop (IOSS)

- Cross-border distance selling in the EU: the One Stop Shop (OSS)

- Why OSS may only be a transitional solution for cross border trade

- Will new postal fees for IOSS effectively end the UPU universal service in the EU?

Ecommerce’s

‘Big Bang’

On 1 July 2021, the EU VAT e-commerce package comes into force.

In this, the second in our Ecommerce Big Bang series, we outline the impact of the new regulation on the most affected area – the import of commercial items into the EU – and the new simplified option for paying import VAT, the Import One Stop Shop (IOSS).

Shipping to the EU – What changes on 1 July 2021?

By digitalizing all import VAT and customs clearance processes for commercial items bought by consumers (B2C), the EU VAT e-commerce package changes the ecommerce business model, impacting import VAT, customs, transport safety and product security.

As outlined in the first article in this series, the key changes are:

- Removal of import VAT exemptions on goods valued below EUR 22

- Marketplaces liable for the collection of VAT on all transactions processed through their platforms

- Mandatory digital customs clearance for all goods entering the EU (EAD – electronic advance data)

- Introduction of the Import One Stop Shop (IOSS) to simplify import VAT payment

The goal of IOSS: simplification

The majority of commercial item consigments to the EU are valued at less than EUR 22 – or at least claim to fall under this level. Therefore, to date, they have not been subject to import VAT, or customs duties.

Additionally, thanks to paper-based customs clearance procedures managed by the postal operators, sending these items by post was also a very simple and inexpensive solution, with customs clearance usually offered as a free service for B2C shippers.

This changes completely on 1 July 2021.

- Import VAT must be paid on every consignment, irrespective of its value.

- Each consigment must be cleared digitally, with the relevant data submitted to customs prior to shipment (electronic advance data – EAD).

('Duty unpaid' is still possible, but here the logistics provider will have to collect the import VAT from the recipient and then settle the account with customs. Where the import VAT is unpaid, the commercial items are returned to the sender, at their expense.)

Consequently, many shippers who have so far only shipped below a value of EUR 22 will be confronted with the issue for the first time, needing to register for and pay import VAT in EU destination countries they have not dealt with so far.

The existing model for paying import VAT is quite complex: a 3rd country seller (e.g., in China, USA, India, Russia, UK) sending shipments to the EU must register with the local tax office in each EU destination country in which a buyer is located, and pay import VAT in that country.

This option will still be available after 1 July 2021.

However, there is now a second, simplified option for paying import VAT when sending consigments to more than one EU destination country: the Import-One-Stop-Shop (IOSS).

The advantages of the IOSS

- Fewer process steps: Electronic interfaces selling merchandise to buyers

in the EU declare and collect the import VAT due at the point of sale (PoS). This is more efficient than the current practice of collecting import VAT at a later stage, i.e., when the

goods are physically imported into the EU.

- Clarity for the buyer: The buyer knows and pays the VAT applicable for their purchase at the PoS, and can be confident that they will not be faced with additional payment demands when the goods are delivered.

- Streamlined process: Suppliers only need to register and pay import VAT in 1 EU Member State for sales to buyers located throughout the EU. The consolidated import VAT for all transactions to all EU destination countries is paid to this single tax authority on a monthly basis.

- No import duties: Commercial consignments

using the IOSS scheme are exempt from import duties, as the applicable

import VAT has been collect at the PoS.

- Efficient customs clearance: IOSS enables consolidated presentation of consignments to 1 customs authority for release for free circulation in all of the EU. (The IOSS scheme is the exemption to the rule that the competent customs office which declares for release for free circulation is the customs office situated in the EU Member State in which the dispatch or transport of the goods ends.)

Preconditions for using IOSS

- The IOSS is designed for distance sales of goods which are dispatched from outside the EU to a consumer inside the EU (B2C).

- The value of commercial items in a consignment is less than EUR 150. Where the total order exceeds EUR 150 it may be useful to split orders into multiple consigments. (The existing model of registration in each destination country must be applied for consignments exceeding EUR 150.)

- Goods must not be subject to excise duties (mostly alcohol or tobacco products).

- Suppliers who are entities from a 3rd country outside the EU, must use a VAT intermediary (fiscal representative) to register for IOSS.

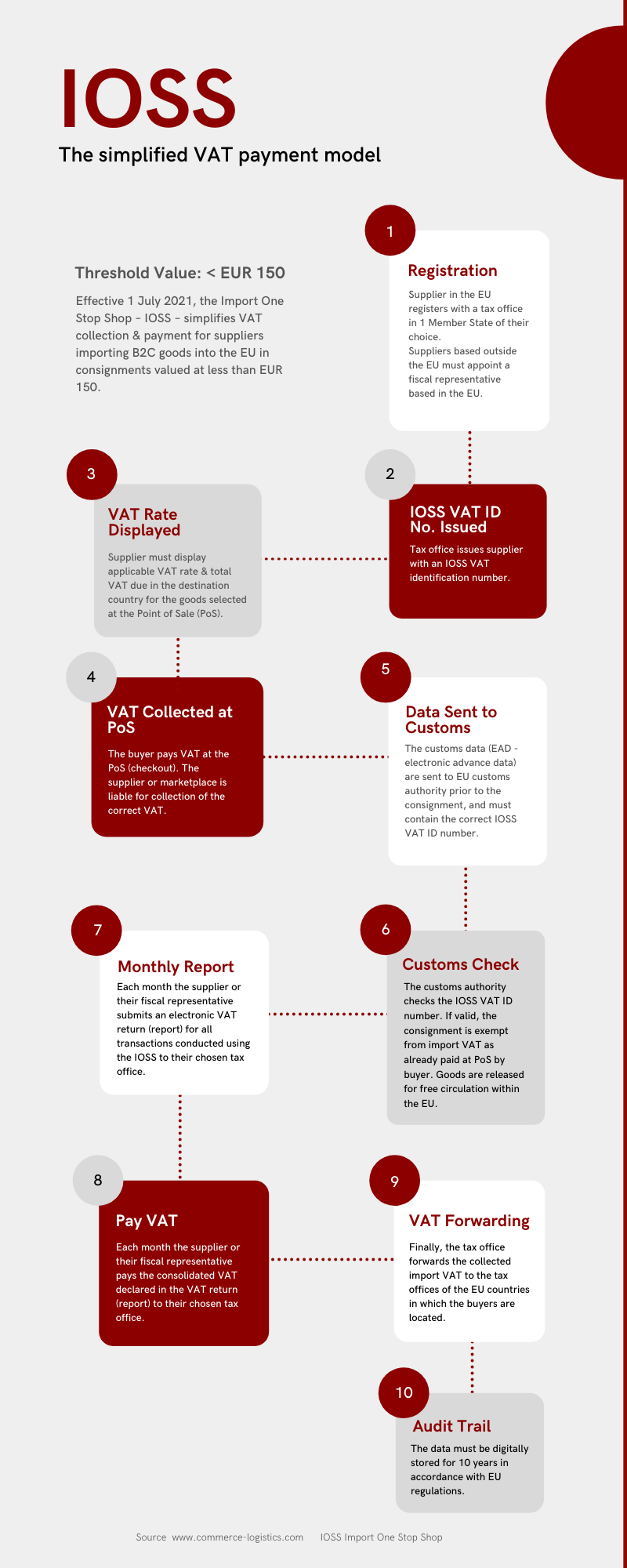

The IOSS workflow in 10 easy steps

- Registration: Suppliers in the EU register with a tax office in 1 Member State of their choice. Suppliers based outside the EU must appoint a fiscal representative based in the EU.

- IOSS VAT ID No. issued: The tax office issues the supplier with their IOSS VAT identification number.

- VAT rate displayed: The supplier must display the applicable VAT rate & total VAT due in the destination country for the goods selected at the PoS.

- VAT collected at PoS: The buyer pays the VAT due at the PoS (checkout). The supplier or marketplace is liable for collection of the correct VAT.

- Data sent to customs: The customs data (EAD - electronic advance data) are sent to the EU customs authority prior to shipping of the consignment, and must contain the correct IOSS VAT ID number.

- Customs check: The customs authority checks the IOSS VAT ID number. If valid, the consigment is exempt from import VAT, as already paid by buyer at PoS.

- Monthly report: Each month the supplier or their fiscal representative submits an electronic VAT return (report) for all transactions conducted using the IOSS to their chosen tax office.

- Pay VAT: Each month the supplier or their fiscal representative pays the consolidated VAT declared in the VAT return (report) to their chosen tax office.

- VAT forwarding: Finally, the tax office forwards the collected import VAT to the tax offices of the EU countries in which the buyers are located.

- Audit trail: The data must be digitally stored for 10 years in accordance with EU regulations.

Alternatives to IOSS?

IOSS is optional.

After 1 July 2021, online vendors and marketplaces will still be able to use the current scheme: taxed at importation into the EU member state; buyer is liable; registration with tax authorities in all EU destination countries, and the competent customs office for declaring release for free circulation is the customs office situated in the EU Member State in which the dispatch or transport of the goods ends.

However, the popular 'entry consolidation model' used by ecommerce, in which all shipments to the EU are customs cleared in a single location (airport) and then sent to buyers in other EU countries based on the principle of free circulation, is only possible when IOSS is applied.

Without IOSS, the imported goods must be taxed on importation by the destination country, and the customs authority of the country of entry to the EU will no longer be able to manage all shipments to EU.

The impact of IOSS

The CLS Commerce Logistics Specialists expect that:

- IOSS, combined with the simplified customs model for consignments valued < EUR 150 and DDP, will be the dominant business model for B2C cross-border ecommerce of goods imported into the EU.

- Postal operators will be the short-term winners. Many online vendors will not have any IOSS solution in place by 1 July 2021, and lack the required import VAT and customs clearance know-how. They will rely/fall back on the postal delivery solutions.

- Postal operators will charge fees for declaring goods and collecting import VAT from buyers. This has already been observed following BREXIT. Over the medium to long term, the postal operators will lose their de-facto-monopoly on customs clearance (and related delivery) for low-value goods following the abolition of paper-based customs clearance.

- Postal operators will face increased competition from direct-entry-based businesses. The new business model of IOSS & digital customs clearance will be facilitated by data-driven service providers, allowing the clear separation of VAT, customs and logistics/last mile delivery.

- The marketplaces will be the long-term

winners. All big marketplaces are fully prepared for IOSS and have registered with

various tax authorities in the EU. They will (try) to use IOSS to retain the online

vendors on their platform, binding them even more strongly to their proprietary marketplace ecosystems, and attracting new online

vendors by offering a working and cost-effective (perhaps free) VAT management

solution. However, their business model will come under pressure from new developments such as EU4Digital's virtual warehouse, co-developed by CLS Commerce Logistics Specialist Walter Trezek.

Author: Martin Füll Linkedin

Share this article:

- Home ›

- One Stop Europe ›

- IOSS – Import One Stop Shop

The Commerce Logistics Specialists provide the advice and support you need to succeed in this evolving digital commerce & logistics environment.

35+ Years' Experience

We serve a wide variety of European & international clients in all areas of Digital Commerce & Logistics.

Powerful Network

We work directly with the EU Commission, UPU, public authorities, regulators, global associations & major industry stakeholders.

Shaping the Industry

We are international experts in our field, chosen to help determine tomorrow’s European and global standards.

Contact us to find out more.