- Home ›

- One Stop Europe ›

- Electronic Advanced Dataset

Electronic Advanced Data Dataset

2021: No cross-border delivery without electronic advanced data (EAD) datasets

At A Glance

- A brief overview of EU & UPU legislation for a single, shared dataset as the basis for VAT, customs, and transport declarations

- UPDATE: the specifications for these EAD datasets have now been published as Technical Reports (TR)

Based on the EU Union Customs Codex which came into force in 2013, the European Union has now adopted further regulations which will impact cross-border trade in goods between the EU and third countries.

They include:

- The decision of the Member States to abolish the import VAT exemption limit as of 1.7.2021[1]

- The introduction of the fully-electronic CUSTOMS declaration of all consignments from 1.7.2021[2], as well as

- The decision that the EU must receive advanced TRANSPORT notification of all consignments of goods from third countries, prior to shipment, from 15.3.2021[3]

Together, these three measures are designed to:

- Prevent the circumvention of import VAT and customs duties on goods imported into the EU;

- Improve and speed up the import customs clearance process;

- Enhance the monitoring of safety regulations;

- Avoid the import of counterfeit goods & transport of restricted products.

Electronic advanced data (EAD)

A prerequisite for implementing all these regulations, and their smooth application, is the use of electronic advanced data (EAD) dataset by customs and tax authorities, transport companies importing goods from third countries into the EU, and dispatch platforms and digital marketplaces who enable the electronic exchange of this data.

The necessary elements in this EAD dataset are each specified in the underlying legal acts, and must be forwarded by the transport companies, marketplaces and platforms to the competent customs or fiscal authorities.

EAD dataset applies to 3 categories of goods consignment

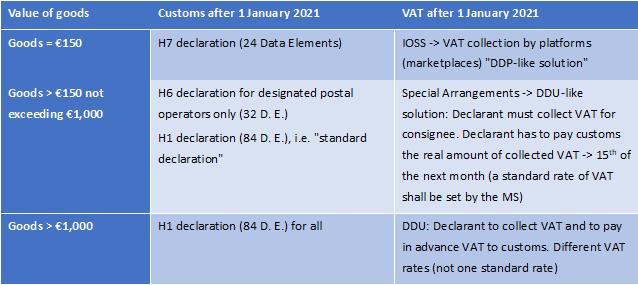

The European legislator stipulates that goods consignments are divided into three value categories.

- The "super-reduced data set"[4] applies to goods shipments with a value of up to €150;

- The "reduced data set" applies to goods shipments valued between €150 and €1,000 (if lodged by a designated postal operator (DO), otherwise the complete data set will apply);

- The “complete data set” must be lodged with the customs and tax authorities by the transport companies for goods consignments with a value of more than €1,000.

Figure 1: VAT & Customs duties on goods valued up to €150 before and after 2021 (*Member State in which the customer is located)

Figure 1: VAT & Customs duties on goods valued up to €150 before and after 2021 (*Member State in which the customer is located)The 3 value categories applied to goods from third countries into the EU for customs and import duty purposes have different VAT rate implications:

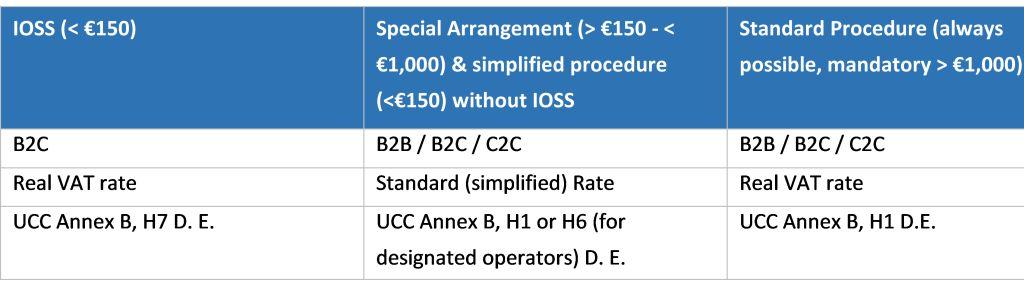

Figure 2: Different VAT regimes applied to the 3 value categories & the different EU Customs Data Model (CDM)

Figure 2: Different VAT regimes applied to the 3 value categories & the different EU Customs Data Model (CDM) Figure 3: VAT & Customs duties on goods valued at €150 and above after 2021. Customs must be paid according to the UCC Annex B column "H7", "H6" or "H1" specification; the Import-One-Stop-Shop VAT Identification number scheme (IOSS) will be the preferred method of marketplaces and/or platforms, following the "deemed seller" qualification of the EU VAT law.

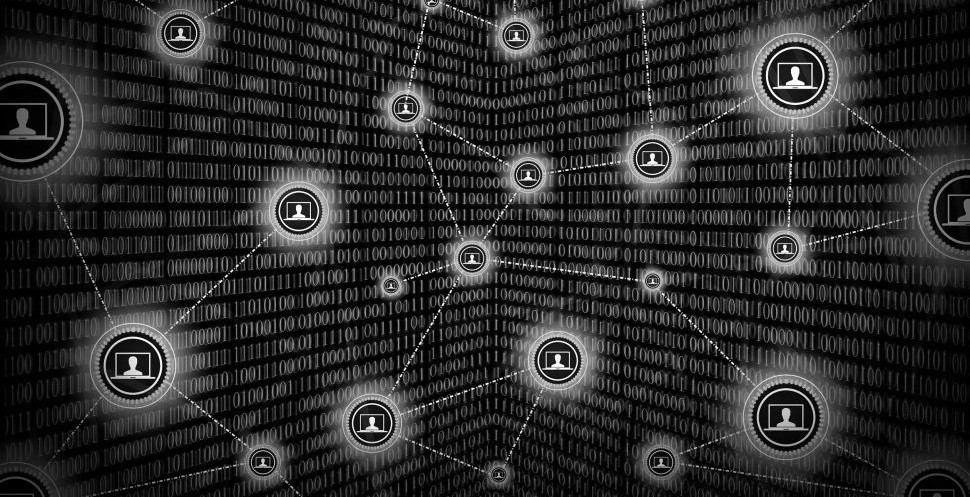

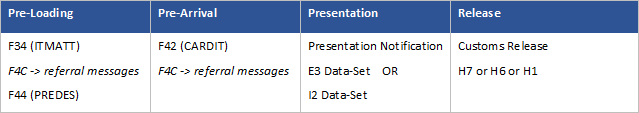

Figure 3: VAT & Customs duties on goods valued at €150 and above after 2021. Customs must be paid according to the UCC Annex B column "H7", "H6" or "H1" specification; the Import-One-Stop-Shop VAT Identification number scheme (IOSS) will be the preferred method of marketplaces and/or platforms, following the "deemed seller" qualification of the EU VAT law. Figure 4: Import Control System 2 (ICS2) will require a pre-declaration prior to loading in the country of origin for all postal items (commercial items)

Figure 4: Import Control System 2 (ICS2) will require a pre-declaration prior to loading in the country of origin for all postal items (commercial items)EAD dataset needed for customs, VAT, and transport security

Technical specifications to map data elements for EAD systems, which originate from Universal Postal Union technical and messaging specifications following the UPU-WCO Data Model and which are needed to transfer the EAD datasets to the customs and tax authorities, and identify the commercial items and consignments (merchandise letters / small-packets and parcels), are being drafted by the European Committee for Standardisation (CEN).

These 3 datasets - Customs, VAT, and Transport Security - provide information about the sender, the identification on the consignment, the recipient, the content including the tariff number, and the value.

Unified dataset

provides global EAD solution & seamless cross-border ecommerce

The designated postal operators currently entrusted with operating today’s EU simplified customs procedure have little opportunity to collect these datasets themselves. Instead they rely on the data provided from the deemed seller, the consignor or declarant.

In contrast, freight forwarders and express operators already receive detailed data from the senders on the content of the consignments they transport .

A large number of cross-border shipments of goods into the EU from third countries (> 75%) fall within the postal operator network (Universal Postal Union).

To ensure that from 2021 onwards the postal operators receive the required EAD data, the Universal Postal Union decided in April 2019 that the electronic exchange of the so-called ITMATT dataset will become mandatory worldwide, for all cross-border consignments, as of 1 January 2021.

The European Committee for Standardization (CEN), under the mandate of the European Commission (M/548), is preparing the necessary technical specifications and implementation instructions in order to ensure that deemed sellers, consignors, declarants, postal services and carriers are able to apply EAD-processing systems and comply with all 3 data requirements.

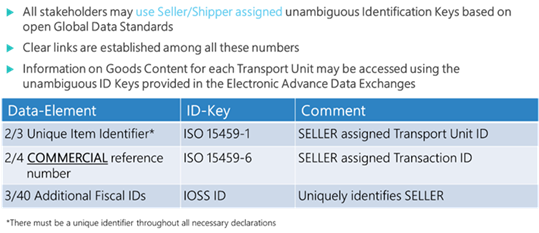

In the process, the data elements from the technical messaging standards of the Universal Postal Union are being brought into conformity with the data elements in the EU Customs Data Model, as well as with the identification on the actual consignments (transport identification, transaction identification, import one-stop shop VAT ID no.).

Figure 5: The 3 data elements in the EAD dataset and the ID keys

Figure 5: The 3 data elements in the EAD dataset and the ID keysThe aim of the two current work items mandated by the European Commission according to the Commission Implementing Decision of 1.8.2016 (M/548) to CEN/TC331 is to bring the existing legal foundations of the EU, the Universal Postal Union, as well as the technical specifications in CEN, ISO and ETSI in line with the data models of the United Nations, the EU and the Universal Postal Union, facilitating the implementation of end-to-end system landscapes that enable standards-compliant solutions for customs, import duties (VAT) and transport security.

The result will be a unified standards environment, applicable to all operators globally, both within and outside the UPU, which will facilitate seamless cross-border ecommerce, and prevent delays caused by missing information, security issues, or unpaid VAT and customs duties.

UPDATE: The guidance documents have now been published in the form of two Technical Reports (TR): further details here.

[1] COUNCIL DIRECTIVE (EU) 2017/2455 of 5 December 2017 amending Directive 2006/112/EC and Directive 2009/132/EC as regards certain value added tax obligations for supplies of services and distance sales of goods

[2] REGULATION (EU) No 952/2013 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 9 October 2013 laying down the Union Customs Code; COMMISSION DELEGATED REGULATION (EU) 2015/2446 of 28 July 2015 supplementing Regulation (EU) No 952/2013 of the European Parliament and of the Council; COMMISSION DELEGATED REGULATION (EU) 2018/1063 of 16 May 2018 amending and correcting Delegated Regulation (EU) 2015/2446 supplementing Regulation (EU) No 952/2013 of the European Parliament and of the Council; COMMISSION DELEGATED REGULATION (EU) 2016/341 of 17 December 2015 supplementing Regulation (EU) No 952/2013 of the European Parliament and of the Council as regards transitional rules for certain provisions of the Union Customs Code where the relevant electronic systems are not yet operational and amending Delegated Regulation (EU) 2015/2446; COMMISSION IMPLEMENTING REGULATION (EU) 2015/2447 of 24 November 2015 laying down detailed rules for implementing certain provisions of Regulation (EU) No 952/2013 of the European Parliament and of the Council laying down the Union Customs Code; COMMISSION IMPLEMENTING REGULATION (EU) 2017/2089 of 14 November 2017 on technical arrangements for developing, maintaining and employing electronic systems for the exchange of information and for the storage of such information under the Union Customs Code; COMMISSION IMPLEMENTING DECISION (EU) 2016/578 of 11 April 2016 establishing the Work Programme relating to the development and deployment of the electronic systems provided for in the Union Customs Code.

[3] REGULATION (EU) No 952/2013 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 9 October 2013 laying down the Union Customs Code; COMMISSION DELEGATED REGULATION (EU) 2016/341 of 17 December 2015 supplementing Regulation (EU) No 952/2013 of the European Parliament and of the Council as regards transitional rules for certain provisions of the Union Customs Code where the relevant electronic systems are not yet operational and amending Delegated Regulation (EU) 2015/2446; COMMISSION IMPLEMENTING REGULATION (EU) 2017/2089 of 14 November 2017 on technical arrangements for developing, maintaining and employing electronic systems for the exchange of information and for the storage of such information under the Union Customs Code; COMMISSION IMPLEMENTING DECISION (EU) 2016/578 of 11 April 2016 establishing the Work Programme relating to the development and deployment of the electronic systems provided for in the Union Customs Code.

[4] COMMISSION DELEGATED REGULATION (EU) 2019/1143 of 14 March 2019 amending Delegated Regulation (EU) 2015/2446 as regards the declaration of certain low-value consignments

- Home ›

- One Stop Europe ›

- Electronic Advanced Dataset

Does this article cover a topic relevant to your business? Access the CLS Business Lounge for the market intelligence you need to stay ahead of the crowd. Find out more