- Home ›

- One Stop Europe ›

- OSS & Cross Border Trade

Cross Border Trade & OSS

EU VAT Ecommerce package: Why OSS may only be a transitional solution for cross border trade

The Ecommerce Big Bang Series

Just as the ‘Big Bang’ of 1986 revolutionized the financial markets, the EU eCommerce VAT Package which comes into effect on 1 July 2021 will redefine global online retail. Our Ecommerce Big Bang series is your guide to the future of European ecommerce:

- Before and after – the key changes to B2C e-commerce

- Importing goods into the EU: the Import One Stop

Shop (IOSS)

- Cross-border distance selling in the EU: the One Stop Shop (OSS)

- Why OSS may only be a transitional solution for cross border trade

- Will new postal fees for IOSS effectively end the UPU universal service in the EU?

The EU VAT Ecommerce package to facilitate cross border trade within, and to, the EU came into force on 1 July 2021. By mandating the fully digital handling of import customs & VAT on all transactions, and with import VAT due on every shipment to the EU, it has already impacted all B2C ecommerce stakeholders, both in Europe and globally.

A major aspect of the new package is to simplify VAT payment schemes for two major use cases – the import of shipments to the EU, and intra-EU cross-border distance sales:

- Importing shipments to EU: the new rule makes all imported shipments taxable, resulting in many new transactions in the low-value area. To simplify VAT payment on these shipments, the EU introduced the Import One Stop Shop (IOSS).

- Intra-EU distance sales: the threshold above which the Supplier must apply the VAT rates of the destination country (where the buyer is located) and register with the tax authority of the destination country has been significantly lowered. To avoid the cost of registering in more than one EU country, the EU has introduced the One Stop Shop (OSS).

The OSS and IOSS are based on similar principles: to simplify the

payment of VAT (OSS) or import VAT (IOSS) for distance sales to buyers in

multiple EU countries with different local VAT rates, by allowing suppliers to

register with a single EU tax authority.

However, while the IOSS model would appear to be a long-term solution, OSS for intra-EU VAT seems to be a transitional solution which may need to be changed over the medium term.

Why?

The OSS model fails to reflect commercial realities of cross border trade

OSS is not a true one-stop-solution and does not work for many of the business models used in cross border trade.

According to the current OSS model, a Supplier may file a single VAT return listing all cross border distance sales to all other EU countries, and pay the consolidated tax debt to one tax authority in their country of residence.

However, Suppliers who hold stock outside their country of residence will not be able to benefit fully and achieve the goal of a one-stop solution. Even if the Supplier opts to use OSS, they are still obliged to register in every single country in which they hold stock.

Unfortunately, warehousing stock outside the country of residence is a very common business model, and especially when the Supplier is located in a high-cost country.

Many Western European online shops use warehouses in CEE countries to benefit from the cost advantages this offers. One such example is Poland, in which many warehouses service Suppliers from all over the EU. Many leading 3PL/4PL models – such as Amazon FBA – are based on this model.

Consequently, CLS

assumes that in many cases it will not be possible to achieve the goal of a

unified VAT solution and a single simplified return: German online merchants

operating via warehouses in Poland and the Czech Republic (a common use case)

still need to register with three separate tax authorities.

From a commercial viewpoint, there is no logical reason for this restriction. It can only be assumed that it is a political compromise, but one which makes life harder for many ecommerce stakeholders.

Is the EUR 10k cross border trade threshold a practical solution?

The aim of the VAT threshold for intra-EU distance sales was to

establish a VAT settlement model which simplified business for small suppliers

engaged in cross border trade.

Before 1 July 2021, staying below the threshold (export value between EUR 35k to 100k, according to destination country) brought two benefits:

- The Supplier was not obliged to know the VAT rates of the destination country (or multiple destination countries) and could apply the VAT rates of their country of residence.

- The Supplier was not obliged to register with the tax authority in the destination countries and comply with local tax law.

With the introduction of the OSS on 1 July 2021, the cross border trade threshold was massively reduced – to a total export value of EUR 10k for combined distance sales to all EU countries – but not removed.

Thus the trade distortion remains as the exception to the “Member State of Consumption” principle remains:

I.e., provided that a Supplier does not exceed the all EU-wide threshold of EUR 10k, a German Supplier can sell to Polish Buyers using lower VAT rates than a domestic Polish Supplier (19% vs 23%), and a Supplier in Luxembourg can sell to a German Supplier using a lower VAT rate than a domestic German Supplier (17% vs 19%), etc.

Given that ecommerce is a digital business, with advance electronic data (EAD) at commercial item level now mandatory for any cross border sale (even domestically in some EU-Member States), solutions which correctly display and charge the correct applicable VAT rate are a pre-requisite for cross border digital retail. Even (micro)-SMEs must meet this requirement.

Therefore, the Import One Stop Shop (IOSS) solution – which has no thresholds at all and requires merchants to implement solutions which correctly display and charge the correct VAT rate to EU customers – would seem to be the more mature model.

The complicated

status of cross border trade & VAT settlement

The primary objection to OSS in its current form is differential treatment.

Although it simplifies and unifies VAT settlement for many, settlement remains complicated when merchandise is shipped from locations where the seller of record is not located in the country of taxation.

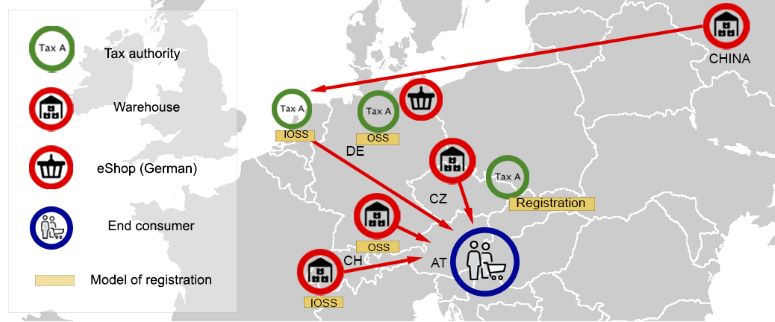

Example: A German online merchant sells goods via his own sales channel (webshop) and via Amazon Germany.

Their stock is stored:

- in their own warehouse in Germany;

- in a warehouse in the Czech Republic (the location of the Amazon FBA warehouse);

- in a Swiss warehouse; and

- in a Chinese warehouse.

The merchant sells to Germany, Austria, The Netherlands, France, and Denmark, generating an annual total export value of EUR 80k.

The example below focuses on the merchant's sales to Austria, where the Austrian VAT rate (20%) must be applied.

- For the merchant’s sales from Germany/their German warehouse to Austria and all other EU destination countries in the EU, the merchant may use OSS (registering with the German tax authority they are already registered with for domestic sales).

- As the merchant also has stock stored in another EU country (Czech Republic), they are also obliged to register with the Czech tax authority and obtain a Czech tax number.

- When the merchant ships goods from their Swiss or Chinese warehouse, the goods cross the customs border to the EU and are imported to EU: import VAT must be applied (20% when selling to Austria), and the supplier may use IOSS. The merchant can freely choose the country in which they register for IOSS; in this example, they choose The Netherlands, because they are using Amsterdam airport for import and customs clearance, and they are also settling import VAT for their Swiss transactions with the Dutch tax authority.

VAT registration follows warehouse location

In the current VAT OSS system, neither movements of retail inventory across EU countries, nor the onward sale of that inventory, are eligible for the VAT OSS system. As a result, and despite the 2021 changes introduced by the VAT Ecommerce Package, businesses are still required to register for VAT in every country in which they store goods (even where there are no sales activities in the storage location).

Obtaining multiple VAT registration numbers is proving to be a significant burden for businesses, requiring them to go through the lengthy and costly process of obtaining a VAT registration number in several Member States.

This complexity is having an adverse effect on EU cross border trade.

Step up, IOSS!

IOSS is clearly the more mature model and a true one-stop-solution.

The supplier may choose freely a tax authority of their choice; receives a unique IOSS VAT ID Number which identifies all distance sales transactions; files only one tax return, and the consolidated import VAT is passed on to the Member States in the background.

Simplifying VAT registration by extending the VAT OSS will lower compliance costs and reduce administrative burdens. It will make it easier and faster to register and pay VAT throughout the EU, secure better access to intra-EU trade, and become more competitive in an increasingly globalised and omnichannel retail environment.

It will help those (M)SMEs supposedly protected by the lowered EUR 10k threshold to exploit the untapped ecommerce business opportunities in the EU Single Market.

EU Member States will benefit from improved VAT compliance and a simple solution to ensure all cross-border goods movements can be easily reported and audited within a single OSS scheme. Clear and simple rules throughout the EU supporting digital retail by maintaining (M)SMEs data sovereignty will lead to an increase in trade, and consequently additional VAT revenues.

EU consumers will benefit from a larger choice of products and more competitive prices when shopping online.

CLS therefore supports the European Commission’s vision, already outlined in its Fair and Simple Taxation Package, to further reduce VAT-related barriers for cross-border trade in the EU. Amending the EU VAT Directive and moving to a single EU VAT registration would enable business to provide services and/or sell goods anywhere in the EU.

Unsure how these changes will impact your business? Contact us for a

free initial consultation.

The CLS Commerce Logistics Specialists are actively shaping the new, legal environment for digital commerce at the Universal Postal Union (UPU), as experts on EU Commission Working Groups (DG TAXUD, DG MOVE), and through Ecommerce Europe (the umbrella association of Europe’s national ecommerce associations), and European Standardization (CEN). CLS is supporting and advising a variety of stakeholders in the industry – postal operators, logistics service providers, online shops and marketplaces.

- Home ›

- One Stop Europe ›

- OSS & Cross Border Trade

35+ Years' Experience

We serve a wide variety of European & international clients in all areas of Digital Commerce & Logistics.

Powerful Network

We work directly with the EU Commission, UPU, public authorities, regulators, global associations & major industry stakeholders.

Shaping the Industry

We are international experts in our field, chosen to help determine tomorrow’s European and global standards.

Contact us to find out more.